Crypto News

Latest news from Crypto market.

Pudgy Penguins Token Shoots Up 7% After Browser-Based Game Featuring PENGU Announced

Popular NFT brand Pudgy Penguins announced the launch of a free-to-play browser-based game, ‘Pudgy World', on Monday, its latest effort to expand its universe and audience reach. This Penguin Is Not Alone The game, touted as one of the “most technically advanced” browser-based games, allows players to explore 12 unique “towns” and features Pudgy Penguins's mascot PENGU.

...keep reeding on benzinga.com

PIPPIN declines 11% amid $2 mln derivatives outflows – What's next?

PIPPIN suffered major capital flight, yet some investors still believe it's a good buy.

...keep reeding on ambcrypto.com

Saylor Reloads? Bitcoin Buy Signal Appears As BTC Nears $67K

Strategy, the company that has built its identity around hoarding Bitcoin, is now sitting on paper losses — and buying more anyway. The company's average purchase price sits at roughly $75,985 per coin, well above where Bitcoin is trading today at around $66,850.

...keep reeding on newsbtc.com

Analyst Sees Market Shift as Key Binance Bitcoin Index Drops to 0.35

Binance's Bitcoin derivatives index has fallen to 0.35, with analysts noting similar readings appeared near past market lows.

...keep reeding on cryptopotato.com

Bitcoin jumps past $70,000 as war volatility fades

BTC rebounded from about $65,000 as crude oil retreated and institutional flows helped stabilize the market.

...keep reeding on coindesk.com

Ethereum Price Climbs Past $2,000, $2,200 Now in Bullish Crosshairs

Ethereum price started a recovery wave from the $1,920 zone. ETH is now back above $2,000 and might aim for more gains in the near term.

...keep reeding on newsbtc.com

Tom Lee's Bitmine sends 5,300 ETH worth $11M to Coinbase, possibly for staking

Bitmine's strategic ETH move to Coinbase could enhance staking yields, influencing Ethereum's market dynamics and institutional adoption. Tom Lee's Bitmine sends 5,300 ETH worth $11M to Coinbase, possibly for staking.

...keep reeding on cryptobriefing.com

Renowned Analyst Reveals Bitcoin's True Value, Says Previous Fair Value Was Miscalculated

Renowned cryptocurrency analyst PlanC has shaken the crypto sector by stating that Bitcoin's fair value currently sits around $101,000. Through a post on X, the expert claimed that traditional methodologies used by most analysts, such as OLS regression or quantile linear regression, contain statistical flaws that distort the true price of the pioneer cryptocurrency.

...keep reeding on crypto-economy.com

South Korea's Bitcoin Treasury Bet Hits a Wall

A wave of small South Korean companies rushed to copy the Strategy (formerly MicroStrategy) playbook in 2025 — buying Bitcoin with borrowed money and calling it a treasury strategy. The cracks are now showing.

...keep reeding on beincrypto.com

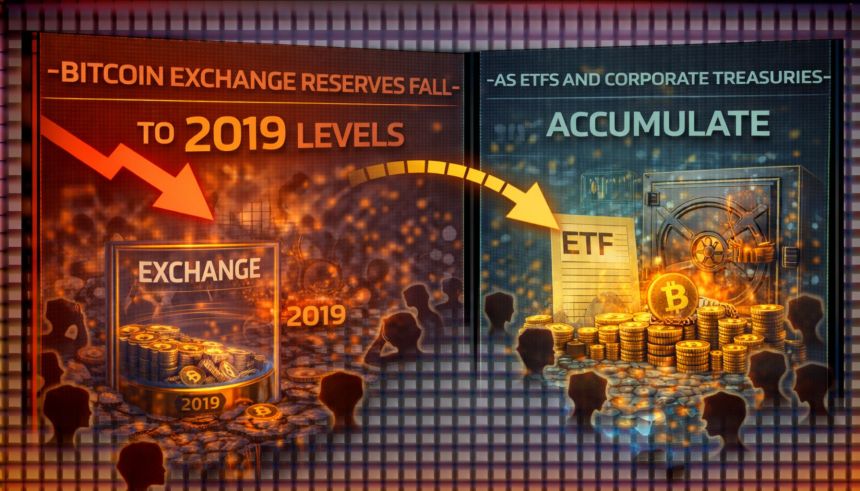

Bitcoin Exchange Reserves Fall To 2019 Levels As ETFs And Corporate Treasuries Accumulate

Bitcoin continues to trade below the $70,000 level as the broader crypto market navigates another period of heightened volatility. After several attempts to regain upward momentum, price action has remained unstable, reflecting ongoing uncertainty across global financial markets.

...keep reeding on newsbtc.com

Bitcoin hints at accumulation after $67K drop – What it means for BTC?

Bitcoin's potential for a near-term rally may not be out of the question.

...keep reeding on ambcrypto.com

AVAX Rockets Higher After Historic Week on the Network

TL;DR: One of the most dynamic weeks in its operational history concluded for Avalanche, consolidating itself in the market as one of the fastest and most scalable Layer-1 networks. The massive surge in C-Chain activity shows an ecosystem growing both technically and commercially.

...keep reeding on crypto-economy.com

Trump-backed American Bitcoin insider buys 68,000 ABTC shares in fresh stock purchase

The insider's stock purchase reflects strong confidence in Bitcoin's long-term potential, potentially influencing market perceptions and investor sentiment. Trump-backed American Bitcoin insider buys 68,000 ABTC shares in fresh stock purchase.

...keep reeding on cryptobriefing.com

Bitcoin Price Reclaims Ground, Can Bulls Flip Market Momentum?

Bitcoin price started a recovery wave from the $65,500 zone. BTC is now consolidating and might aim for more gains above $69,500.

...keep reeding on newsbtc.com

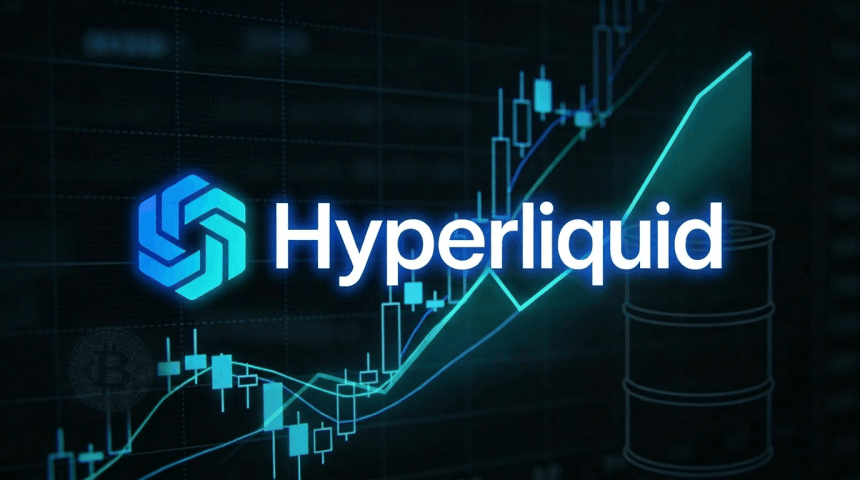

Hyperliquid Jumps 12.63% as ZEC Pops, TRX Slips — Daily Movers Mar 10

Hyperliquid jumped 12.63% to $34.18, leading the market's advance, according to CoinGecko data. The token's market cap stands at $8.15B.

...keep reeding on thecurrencyanalytics.com

Bitcoin Holds $69K Mark Despite Wild Oil Swings and Global Market Chaos

Bitcoin sits pretty much steady near $69,000 as Monday trading kicks off, shrugging off last week's roller coaster ride that saw the crypto briefly spike before getting hammered back down.

...keep reeding on thecurrencyanalytics.com

Solana Price Prediction: SOL Just Flipped Ethereum in Critical $600 Billion Metric — Is Solana About to Explode?

Something big just happened on Solana, and most traders barely noticed.While the market focused on price charts, Solana quietly flipped the leaderboard in stablecoin activity. In February alone, the network processed about $650 billion in stablecoin transfers, surpassing both Ethereum and Tron.For years, Tron dominated stablecoin transfers, especially USDT.

...keep reeding on cryptonews.com

Bitcoin, Ethereum, XRP, Dogecoin Rally As Trump Says Iran War 'Pretty Much' Complete: Analyst Predicts BTC Moves If Oil Keeps Falling

Leading cryptocurrencies lifted alongside stocks on Monday after President Donald Trump said that the U.S. campaign against Iran could be nearing its end. Cryptocurrency 24-Hour Gains +/- Price (Recorded at 9:30 p.m.

...keep reeding on benzinga.com

Hyperliquid Traders Rise in Arms as Bitcoin Hits 7-Day Low And Oil Soars

Bitcoin is slipping to a seven‑day low as oil is screaming higher on Iran war fears. But the real action is unfolding somewhere else entirely: Hyperliquid, where a new class of traders is turning to its tokenised oil perps.

...keep reeding on newsbtc.com

DEEP: $0.033 resistance is back in focus – But shorts pose a problem

DEEP breaks its descending channel as rising RSI and short liquidations hint at strengthening bullish pressure.

...keep reeding on ambcrypto.com